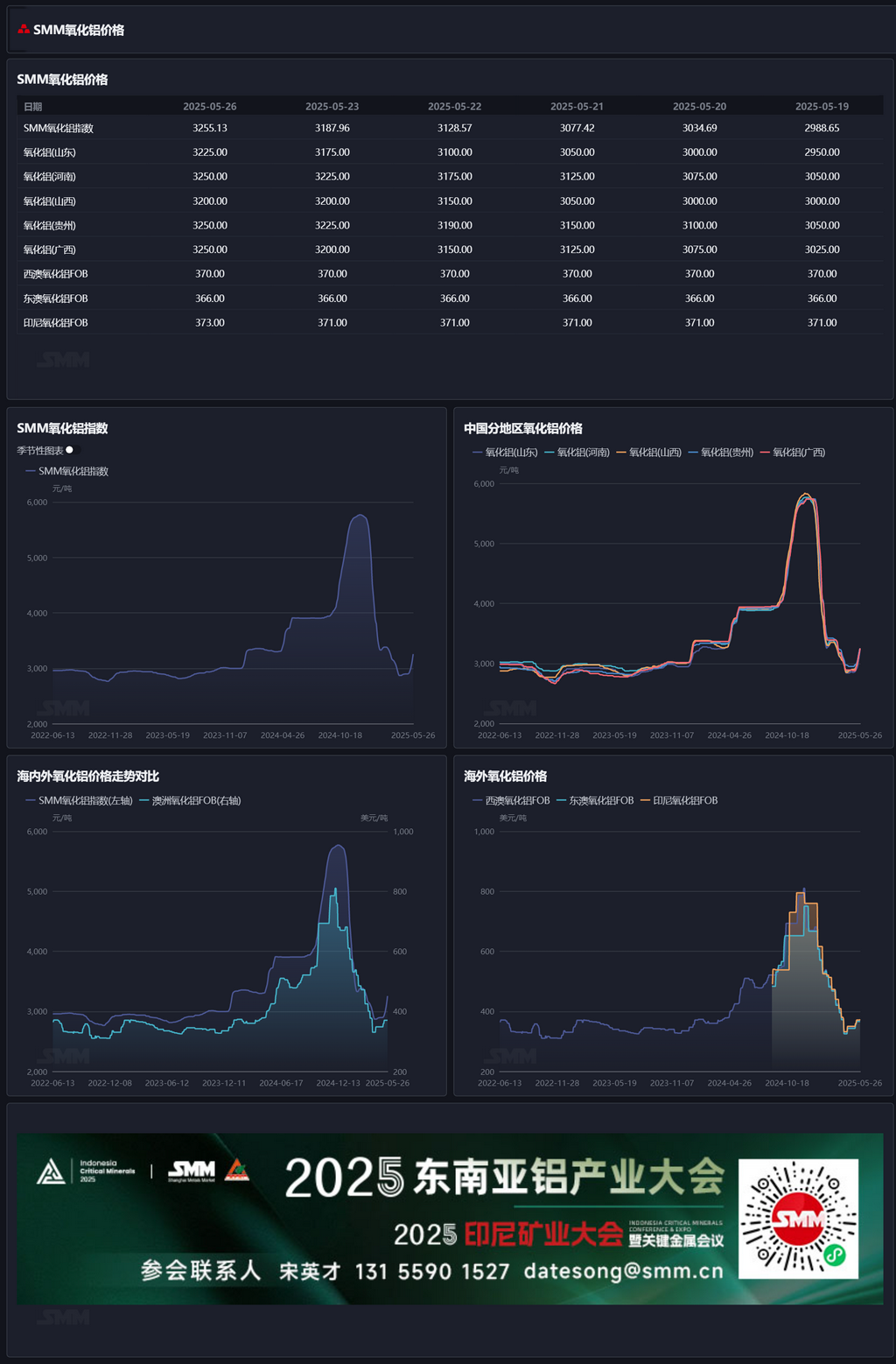

SMM Alumina Morning Comment on May 27

Futures Market: Overnight, the most-traded alumina 2509 futures contract opened at 3,061 yuan/mt, with a high of 3,062 yuan/mt, a low of 2,980 yuan/mt, and closed at 3,001 yuan/mt, down 59 yuan/mt or 1.93%. Open interest stood at 401,000 lots.

Ore Market: As of May 26, the SMM Import Bauxite Index was reported at $73.33/mt, up $0.47/mt from the previous trading day. The SMM Guinea Bauxite CIF average price was reported at $74/mt, unchanged from the previous trading day. The SMM Australia Low-Temperature Bauxite CIF average price was reported at $70/mt, unchanged from the previous trading day. The SMM Australia High-Temperature Bauxite CIF average price was reported at $65/mt, unchanged from the previous trading day.

Industry Updates:

- Overseas Alumina Transactions: On May 23, 30,000 mt of alumina was traded overseas at a transaction price of $373/mt FOB Indonesia, with a shipment schedule for late July.

Basis Report: According to SMM data, on May 23, the SMM Alumina Index had a premium of 208.13 yuan/mt against the latest transaction price of the most-traded contract at 11:30.

Warrant Report: On May 26, the total registered alumina warrants decreased by 6,599 mt from the previous trading day to 150,400 mt. In Shandong, the total registered alumina warrants remained unchanged at 601 mt from the previous trading day. In Henan, the total registered alumina warrants remained unchanged at 3,001 mt from the previous trading day. In Guangxi, the total registered alumina warrants decreased by 900 mt from the previous trading day to 6,304 mt. In Gansu, the total registered alumina warrants remained unchanged at 6,306 mt from the previous trading day. In Xinjiang, the total registered alumina warrants decreased by 5,699 mt from the previous trading day to 134,200 mt.

Overseas Market: As of May 26, 2025, the FOB Western Australia alumina price was $370/mt, with an ocean freight rate of $21.40/mt. The USD/CNY selling rate was around 7.19. This price translates to approximately 3,261 yuan/mt for the external selling price at major domestic ports, which is 5.76 yuan/mt higher than the domestic alumina price. The alumina import window remained closed.

Summary: Last week, some enterprises in north China underwent maintenance, while some alumina refineries in south China completed maintenance, leading to a rebound in operating capacity. Overall, the national alumina operating capacity increased by 1.09 million mt MoM last week. In the near future, some new alumina enterprises are expected to undergo maintenance, while some enterprises are expected to complete maintenance and resume operating capacity. Overall, the operating capacity is expected to continue to rebound slightly. Affected by supply-side disruptions in the bauxite market, bauxite prices have risen, and the cost support for alumina is expected to strengthen. Coupled with the fact that the short-term fundamentals have not shifted to a surplus pattern, there is still upward momentum in prices. However, with the recovery of supply, alumina prices may encounter resistance to further increases. In the short term, spot alumina prices are expected to hold up well.

[The information provided is for reference only. This article does not constitute direct advice for investment research and decision-making. Clients should make decisions cautiously and should not replace their own independent judgment with this information. Any decisions made by clients are not related to SMM.]